Flex is the only automated insurance revenue cycle merchant service, paying your commercial and workers’ comp claims in three days while returning business intelligence to improve your insurance revenue cycle.

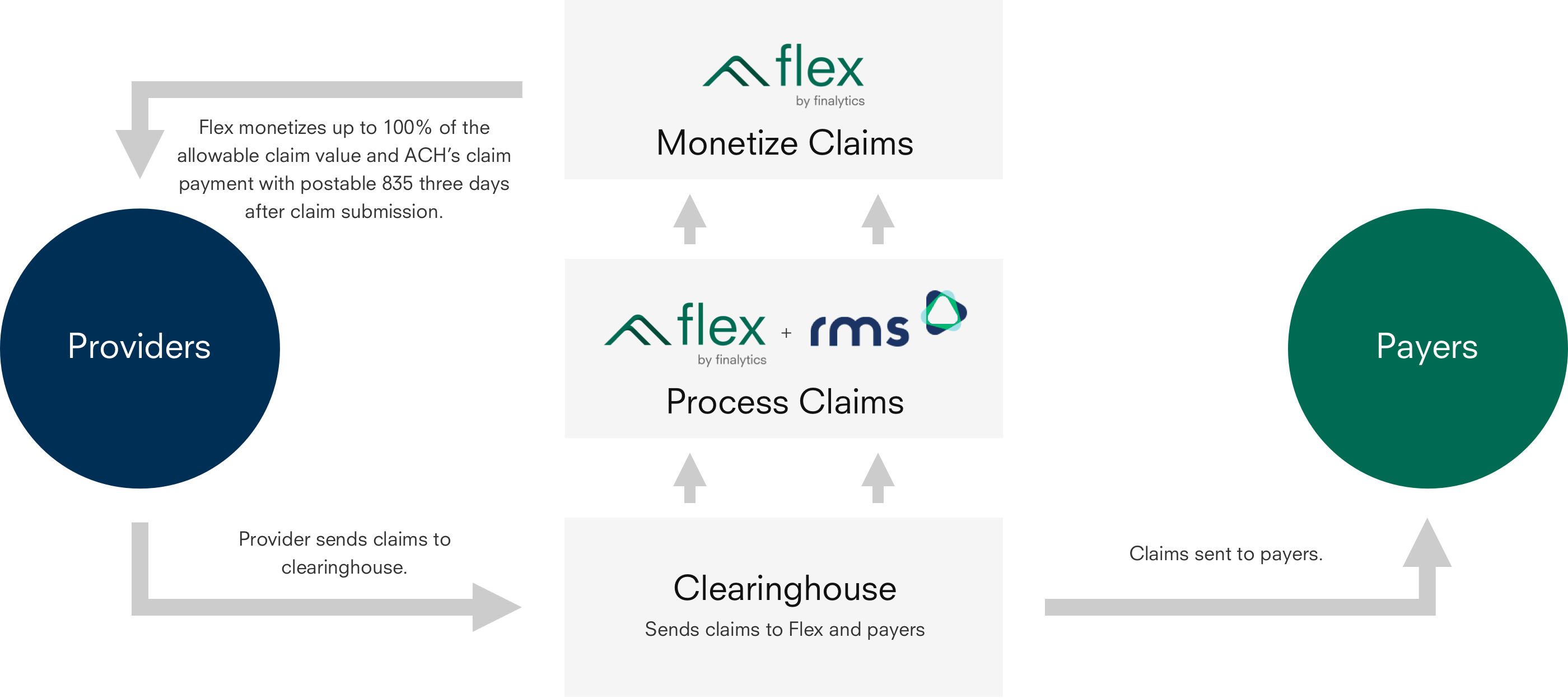

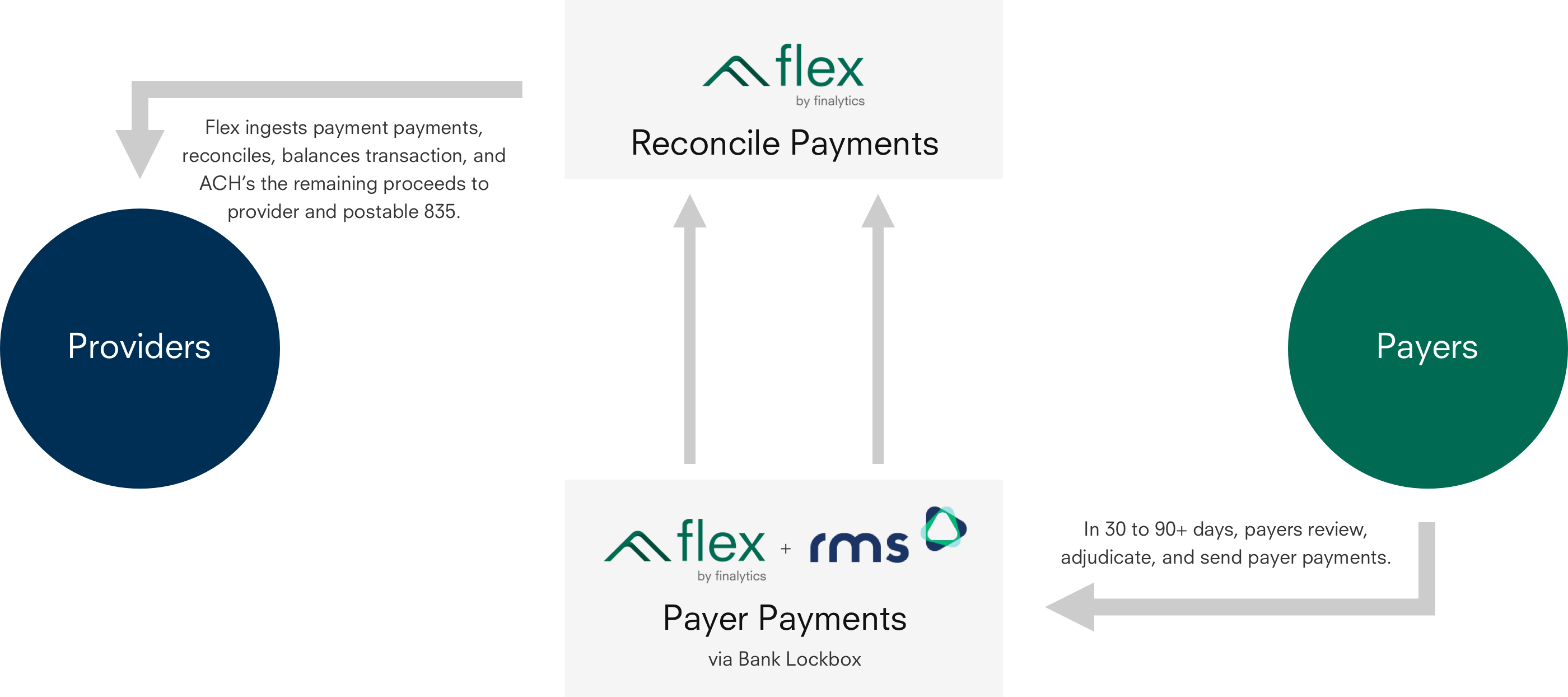

Request a DemoIntegrated with RMS, Flex is an end-to-end platform monetizing up to 100% of your allowable claim value in 3 days via ACH payment and postable 835.

Flex significantly reduces days insurance outstanding by 80%+ and correspondingly improves your balance sheet and cash flow.

Flex automation distills your insurance workflows and connects your financial claim-payment data for clear line of sight into your insurance revenue cycle and business performance.

Please note: A Flex account requires activation of an RMS account.

Monetize 80%-100% of your commercial and worker’s compensation claims in three days for faster payments, decreased insurance A/R, and reduced insurance workflows.

Some helpful questions that are commonly asked. For more information, please visit our Help Center.

Visit Help CenterWADIO is calculated using the claim values or payer payment times on a weighted basis of each claim payment period in an insurance receivable portfolio.

Why it’s important?

WADIO provides a more accurate depiction of payer reimbursement timelines, taking into consideration the cash value of each claim.

Read our published article about the importance of WADIO here.